richmond county va business personal property tax

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. Business Tangible Personal Property Tax Return2021 2pdf.

Pay Online Chesterfield County Va

Business Personal Property Registration Form An ANNUAL filing is required on all business personal property items located in Richmond County as of January 1 st of each tax year.

. Farmers and business owners are required to attach an itemized list of all. Mixed Beverages - Flat Fee Based on Seating Capacity. 581-3503 of the Virginia Tax Code report all tangible personal property owned and located in the County of Henrico on January 1 2022 that is subject to tax.

Assess individual and business personal property. You have the option to pay by credit card or electronic check. Chesterfield County levies a tax each calendar year on personal property with situs in the county.

What is the deadline for paying the business personal property tax. As stipulated in 581-3518 of the code of virginia it is the responsibility of every taxpayer who owns leases rents or borrows tangible personal property that was used or available for use in a business and which was located in the city of richmond virginia on january 1 2021 to report such property on this return. Most businesses located within Chesterfield County are subject to the Chesterfield County business license tax.

Most persons or corporations owning tangible personal property other than motor vehicles trailers boats or aircraft that is used or available for use in a trade or business including processing businesses but not manufacturing and located within Chesterfield County as of January 1 must file the Return of Business Tangible Personal Property BPP by March 1 to. All returns are due by March 1 of each year. To request a copy of the depreciation schedule please call 804 501-4310.

Most persons or corporations owning tangible personal property other than motor vehicles trailers boats or aircraft that is used or available for use in a trade or business including processing. Failure to do so will result in a personal property tax assessment being made based on the best information available 581 -3519 Code of VA. Welcome to the official Richmond County VA Local Government Website.

Business Tangible Personal Property Tax Return2021 2pdf. The Commissioner of the Revenue and staff. The only exception to this is for boats which must be registered with the Virginia Department of Wildlife Resources DWR or the US.

You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or your checking account. What is the deadline for filing a business personal property tax return. Federal Income Tax Returns Due.

For Real Estate Tax Payments For Personal Property Tax Payments Feel free to contact the office should you have any questions 804-333-3555. A separate form should be submitted for each business location. Payments are due on June 7 and December 6 of each year.

Personal Property taxes are billed annually with a due date of December 5 th. Business Tangible Personal Property. Fax Numbers 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours.

Personal Property Taxes. Businesses who have previously filed will receive a pre-printed return containing the previous years information. Every taxpayer who owns leases rents or borrows tangible personal property that was used or available for use even partial use for a business in Chesterfield County VA on January 1 is to report such property by March 1.

Business personal property required to be reported on this form is not subject to proration. The city of Richmond must be named as co-insured. Other collections include dog registration fees building and zoning permit fees and state taxes.

You can make Personal Property and Real Estate Tax payments by phone. Personal property must then. Henrico County now offers paperless personal property and real estate tax bills.

As stipulated in 581-3518 of the code of virginia it is the responsibility of every taxpayer who owns leases rents or borrows tangible personal property that was used or available for use in a business and which was located in the city of richmond virginia on january 1 2022 to report such property on this return. Business Personal Property Taxes are billed once a year with a December 5 th due date. Review the Business Personal Property and Asset Lists - How to File PDF for help filing.

All property must first be registered with the Virginia Department of Motor Vehicles DMV. The late filing penalty is 10 of the total personal property tax if the Personal Property Return is not filed by the Due Date shown on the return. Personal Property Taxes.

Maintain real estate owner information and county tax maps. We have done our best to provide links to information regarding the County and the many services it provides to its citizens. Unfortunately however when it comes to business personal property taxes across the Commonwealth the only consistent thing about Virginia is its inconsistencies.

The Richmond County Treasurers Office bills and collects Real Estate and Personal Property taxes. Fill Free Fillable Port Of Richmond Virginia Pdf Forms Download the Business Personal Property Form PDF or review Hamptons tax rates. Please contact the Commissioner of Revenue at 804-333-3722 if you have a question about your assessment.

All Food Vendors must provide a current copy of Health Certificate For all vendors located within the Central Business District please contact the Tax Enforcement Office prior to renewal at 804 646-7000. Our primary goal is to serve the citizens of Richmond County in a fair and unbiased manner by providing the highest level of customer service integrity and fiscal responsibility. A consistently high-ranking state for business competitiveness Virginia is known for having a steady tax rate and a relatively business-friendly environment.

The Treasurers Offices mission is to treat all of its customers courteously and fairly while maintaining exceptional professionalism and. We hope you are able to easily move around the site.

Foreign Literature In Thesis Meaning In 2021 Logic And Critical Thinking Critical Thinking Essay

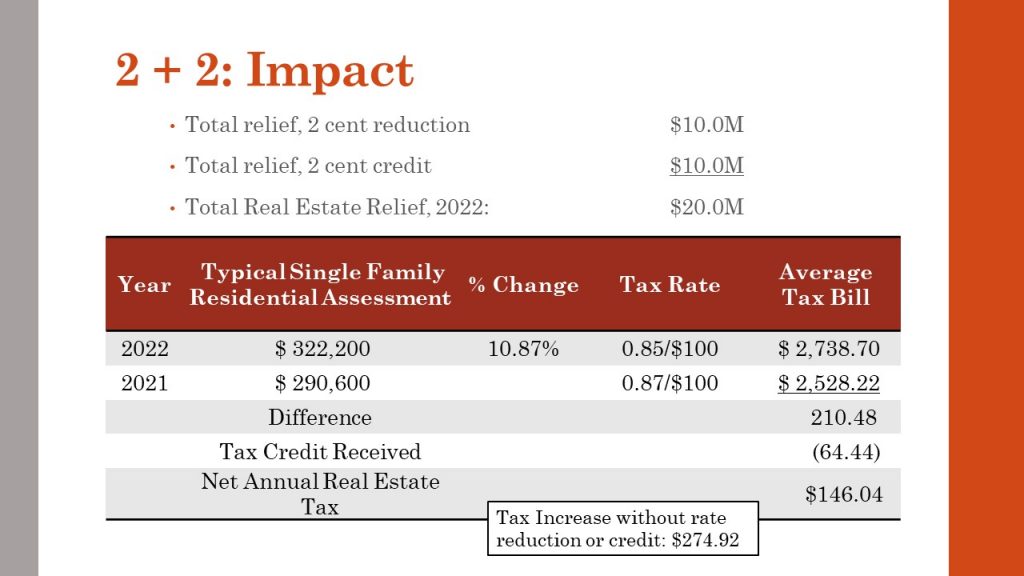

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

From The Archives Richmond Times Dispatch Richmond Drive In Theater Drive In Movie Theater

![]()

Holbrook Officer Involved Shooting Incident Monticello Road Update Officer Involved Shooting Monticello Richmond

Virginia Property Tax Calculator Smartasset

6 80 Acres Land For Sale In Henry County Virginia In 2021 Land For Sale Real Estate Investing Finance

Downtown Farmville Virginia Farmville Virginia Farmville Va Street View

Richmond County Va Commissioner Of The Revenue S Office

Virginia Commonwealth Veteran Benefits Military Com

Virginia Sales Tax Guide And Calculator 2022 Taxjar

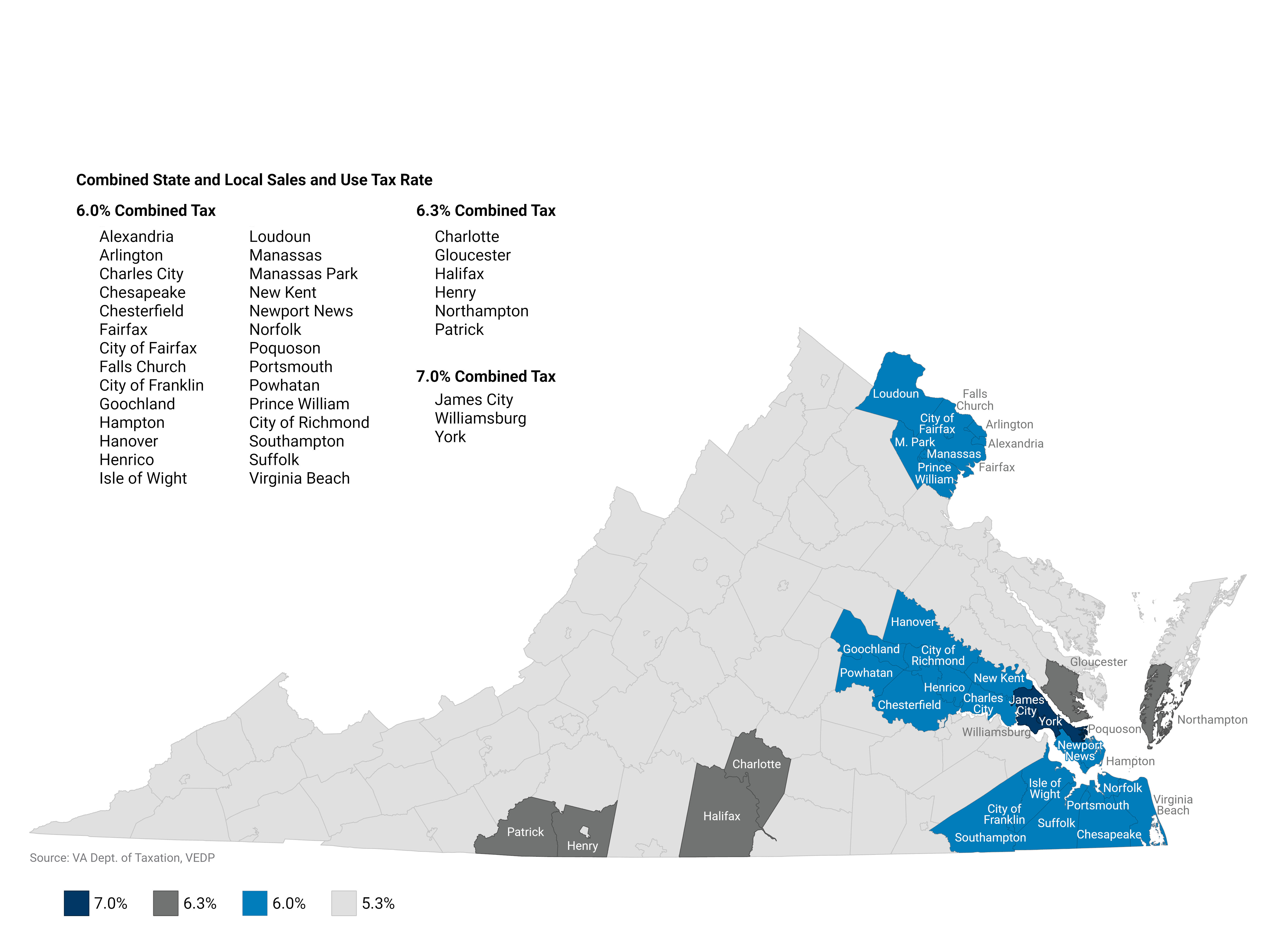

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Personal Property Taxes Commissioner Of The Revenue County Officials Departments Commissioner Of The Revenue County Officials Departments Sussex County Virginia Part Of Virginia S Gateway Region

Virginia Llc How To Start An Llc In Virginia Truic

Pay Online Chesterfield County Va

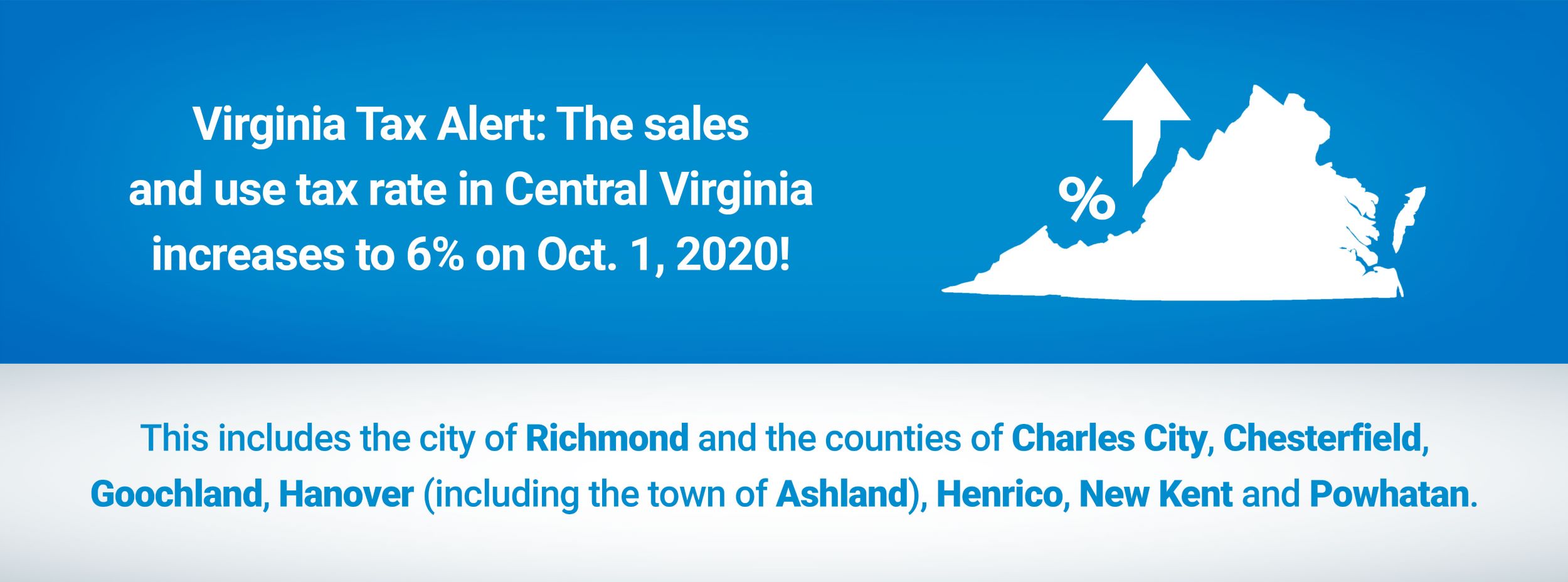

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax