nebraska vehicle tax calculator

There are no changes to local sales and use tax rates that are effective January 1 2022. Nebraska vehicle tax calculator.

What S The Car Sales Tax In Each State Find The Best Car Price

To use the calculators above including the car payments calculator NJ youll usually need to enter some basic information about the vehicle you plan to purchase.

. Here are five additional taxes and fees that go along with a vehicle purchase. 50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services. Install an Interlock Device on your vehicle.

The state of NE like most other states has a sales tax on car purchases. View the Nebraska state fee estimator to verify your registration cost and use our DMV Override to adjust the calculator. With a sales tax rate of 55 in Nebraska this means you are paying an additional amount equal to 55 of the vehicles value at the point of sale.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Steps to Secure your Ignition Interlock Permit. Using the values from the example above if the new car was purchased in a state without a sales tax reduction for trade-ins the sales tax would be.

This example vehicle is a passenger truck registered in Omaha purchased for 33585. 2022 January 2022 and January 2021 04042022 PDF Excel February 2022 and January 2021 05042022 PDF Excel 2021 December 2021 and December 2020 03032022 November 2021 and November 2020. The make model and year of your vehicle.

These fees are separate from. Today Nebraskas income tax rates range from 246 to 684 with a number of deductions and credits that lower the overall tax burden for many taxpayers. Additional fees collected and their distribution for every motor vehicle registration issued are.

The Nebraska sales tax on cars is 5. Money from this sales tax goes towards a whole host of state-funded projects and programs. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV.

Before that citizens paid a state property tax levied annually at registration time. This example vehicle is a passenger truck registered in. Nebraska Sales Tax on Cars.

Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions. Registering a new 2020 Ford F-150 XL in Omaha.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. Nebraska Online Vehicle Tax Estimator Gives Citizens Tax. This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided.

Get your Ignition Interlock Permit Online or at a Driver Licensing Office. The vehicle identification number VIN. If you are registering a motorboat contact the Nebraska Game and Parks Commission.

The documentation fee is set by the dealer but is not negotiable so clarify upfront what the dealer charges. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable.

Online estimates are not available for vehicles over 14 years old. 150 - State Recreation Road Fund - this fee. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

2000 x 5 100. Vehicle Information required Motor Vehicle Tax calculations are based on the MSRP Manufacturers Suggested Retail Price of the vehicle. DMV fees are about 765 on a 39750 vehicle based on a percentage of the vehicles value.

30000 8 2400. The customary doc fee is 299 in Nebraska but may differ as there is no maximum set by the state. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918.

Verify your eligibility online or contact the Department of Motor Vehicles at 402-471-3985. Today nebraskas income tax rates range from 246 to 684 with a number of deductions and credits that lower the overall tax burden for many taxpayers. Vehicles are considered by the IRS as a good that can be purchased sold and traded.

Montana Salary Calculator 2022. The information you may need to enter into the tax and tag calculators may include. The statistics are grouped by county.

The tax commissioner assigned a value. Nebraska Documentation Fees. Submit your paperwork and Certificate of Installation.

Motor Vehicle and Registration fees are based on the value weight and use of the vehicle. 1st Street Papillion NE 68046. Nebraska vehicle tax calculator.

Nebraskas motor vehicle tax and fee system was implemented in 1998. The Nebraska sales tax on cars is 5. Motor vehicle sales tax collection information is compiled from monthly county treasurers reports.

State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660. Like all other goods retailers are required to charge a sales tax on the sales of all vehicles. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. You can do this on your own or use an online tax calculator. In nebraska the sales tax due is reduced if your vehicle purchase is credited with a trade.

Average DMV fees in Nebraska on a new-car purchase add up to 67 1 which includes the title registration and plate fees shown above. 2000 century 2100 boat for sale.

Dmv Fees By State Usa Manual Car Registration Calculator

During National School Bus Safety Week Officials In Maryland Are Bringing To Light A Problem That Does Not Seem To Be School Bus Safety School Bus Bus Safety

Which U S States Charge Property Taxes For Cars Mansion Global

Taxes And Spending In Nebraska

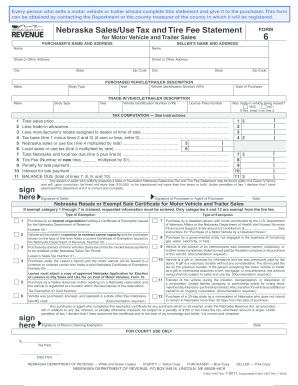

Nebraska Vehicle Sales Tax Fill Out And Sign Printable Pdf Template Signnow

Taxes And Spending In Nebraska

Car Depreciation How Much It Costs You Carfax

50 Plus New Homes In North Charleston Brings Traffic Concerns To Congested Road North Charleston Traffic Dorchester

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Too Slow In The Fast Lane The Florida Law That S Rarely Enforced Florida Law Slow Lane

Car Sales Tax In Nebraska Getjerry Com

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Sales Tax In Nebraska Getjerry Com

It Is Said That Everyone Can Get A Bad Credit Loan However This Is Not Always True There Are Some People That Can Neve Payday Loans Personal Loans Cash Loans

Nj Car Sales Tax Everything You Need To Know

Renew Vehicle Registration License Plates Douglas County

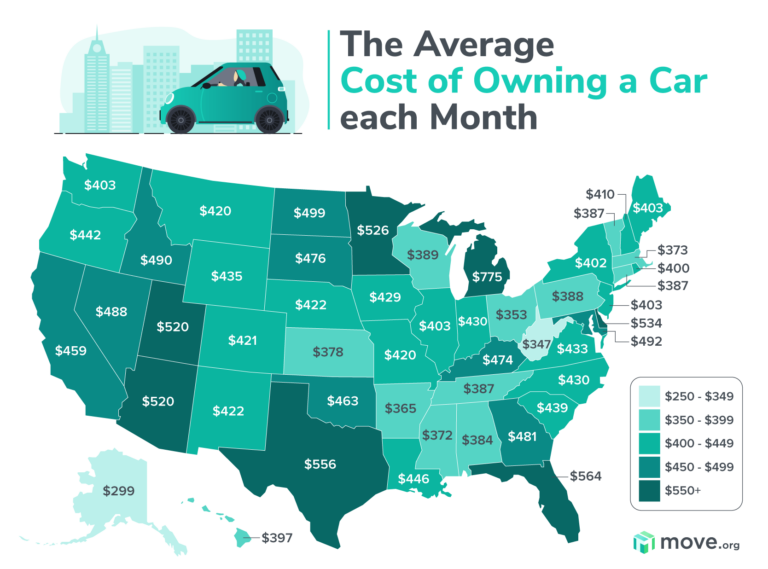

The Average Cost Of Owning A Car In The Us Move Org